In today’s digital world, understanding your credit score is more important than ever. But not all credit scores are created equal. The traceloans.com credit score is quickly becoming a new standard in how people measure their financial health. Whether you’re a freelancer, student, gig worker, or someone with a limited credit history, the traceloans.com credit score is designed to give you a fair shot.

Let’s explore how this score works, why it matters, and how you can take control of it—starting today.

✅ What Is the traceloans.com Credit Score?

The traceloans.com credit score is a modern credit scoring system developed by TraceLoans. It goes beyond traditional FICO scores by considering real-time data, your digital financial behavior, and even your spending patterns.

This means the traceloans.com credit score is perfect for people who don’t have a long credit history—or who are just starting out. Instead of only looking at your credit cards or loans, it takes a broader view of your financial activity.

Why is this important? Because millions of people get rejected by banks for loans, even when they’re financially responsible. The traceloans.com credit score fixes that.

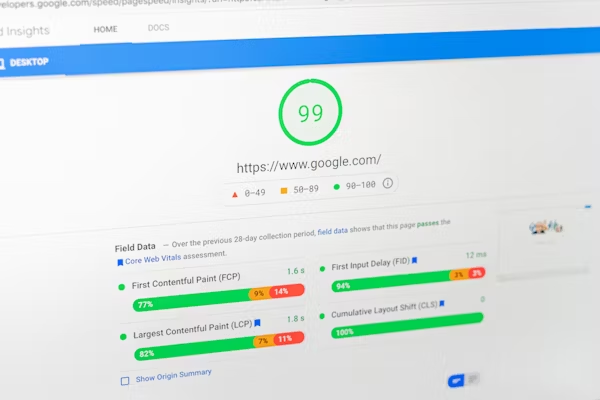

📊 How Does the traceloans.com Credit Score Work?

The traceloans.com credit score uses five main factors:

- Payment History – Do you pay your bills and loans on time?

- Spending Habits – Are you spending wisely, or maxing out your cards?

- Account Age – How long have you had your accounts?

- Income Flow – Is your income stable, even if it’s from freelance or gig work?

- Digital Activity – Are you actively managing your money using apps or tools?

Unlike the big credit bureaus, traceloans.com credit score updates weekly, not monthly. That means you’ll see changes sooner when you make positive moves.

🎯 Why You Should Care About Your traceloans.com Credit Score

If you’re planning to:

- Apply for a personal loan

- Get approved for a new apartment

- Buy a car

- Start a small business

- Or just want better financial deals…

…then your traceloans.com credit score can make or break your chances.

A higher score means lower interest rates, better offers, and more freedom. With the traceloans.com credit score, even people with limited or nontraditional credit can improve their financial standing.

💡 How to Improve Your traceloans.com Credit Score

Improving your traceloans.com credit score is possible for anyone. Here’s how:

1. Pay On Time

Pay your bills, loans, and subscriptions on time. Payment history is a huge part of the traceloans.com credit score.

2. Limit Your Debt

Don’t use all your available credit. Keep balances low and avoid maxing out cards.

3. Link Your Accounts

By connecting your bank accounts and income streams to TraceLoans, you give the system more data to boost your traceloans.com credit score.

4. Engage with Financial Tools

Using budgeting tools, calculators, and credit simulators on traceloans.com can actually improve your score. It shows you’re engaged and learning.

5. Be Consistent

The more consistently you manage your money, the faster your traceloans.com credit score grows.

🔍 Where to Check Your traceloans.com Credit Score

It’s easy and free:

- Visit www.traceloans.com

- Create an account

- Link your banking or income information

- View your personalized traceloans.com credit score

- Get real-time updates, tips, and loan recommendations

You can check your traceloans.com credit score as often as you want—it won’t hurt your credit, because they use soft inquiries.

📉 Low Score? Here’s What to Do

Don’t panic if your traceloans.com credit score is lower than expected. It simply means there’s room to grow. Most users improve their scores within 30–60 days by doing the following:

- Paying down credit cards

- Avoiding new debt

- Using TraceLoans’ credit-building tools

- Setting up payment reminders

- Logging in and checking progress regularly

The system gives you customized suggestions based on your actual habits.

🛑 Common Myths About traceloans.com Credit Score

Myth 1: “It’s not a real credit score.”

Truth: It’s a real, data-driven score used by TraceLoans and several partner lenders.

Myth 2: “It’s only for people with bad credit.”

Truth: Anyone can benefit, whether you’re building or rebuilding your credit.

Myth 3: “It’s the same as FICO.”

Truth: The traceloans.com credit score is different and more flexible than traditional credit scores.

📣 Real User Reviews

Here’s what people are saying about the traceloans.com credit score:

“I had no credit history, but TraceLoans gave me a chance. My traceloans.com credit score improved in just one month.” – Alex, Freelance Designer

“The weekly updates helped me stay on track. I went from 570 to 690 in three months.” – Chris, Ride-share Driver

“It’s better than just waiting around for my FICO to update. I can see changes in real time.” – Mia, Small Business Owner

💼 Loans and Approvals with traceloans.com Credit Score

Once you’ve built up a solid traceloans.com credit score, you can:

- Qualify for personal loans

- Access emergency cash without a traditional credit check

- Unlock lower interest rates

- Even apply for buy-now-pay-later offers with less risk

The platform connects your traceloans.com credit score directly to prequalified offers.

🔐 Is It Safe to Use traceloans.com?

Yes. Traceloans.com uses encryption and bank-level security to protect your data. You control what you share, and you can unlink accounts at any time.

Your traceloans.com credit score data is not sold to third-party advertisers.

📢 Why You Should Feature traceloans.com Credit Score on Your Website

If you’re running a financial blog, educational site, or credit repair service, writing about the traceloans.com credit score is a great way to:

- Improve your SEO rankings

- Offer your readers practical tools

- Build trust with up-to-date financial content

- Attract traffic from people searching for credit-building solutions

The keyword “traceloans.com credit score” is unique, relevant, and growing in popularity.

🏁 Final Thoughts: Take Control of Your Financial Future

Your traceloans.com credit score isn’t just a number. It’s a tool—a reflection of your financial habits, decisions, and goals. And best of all? It’s in your hands.

By staying consistent, paying attention, and making smart money moves, you can raise your traceloans.com credit score and open new doors for your future.

So don’t wait. Start tracking, improving, and taking control with the traceloans.com credit score today.