Roblox has become one of the most popular gaming platforms worldwide, offering endless possibilities for creativity, adventure, and social interaction. Among the countless games on Roblox, Geometry Spot Roblox stands out as a unique, engaging experience that attracts players who love puzzles, geometry, and interactive challenges.

If you’ve heard about Geometry Spot Roblox and are curious about what makes it special, this detailed guide will explore everything from gameplay mechanics, tips, community insights, and why it deserves a place on every Roblox fan’s radar.

What Is Geometry Spot Roblox?

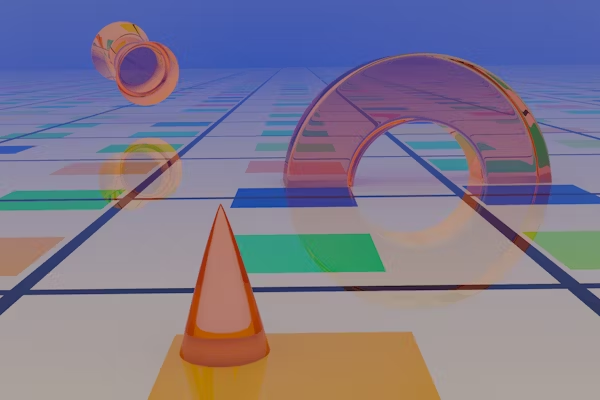

At its core, Geometry Spot Roblox is a game that blends geometric puzzles, exploration, and creative problem-solving. Players navigate through different levels filled with shapes, angles, and spatial challenges, pushing their logical thinking and spatial awareness to the limit.

The game’s design focuses heavily on precision and geometry principles, making it not just entertaining but also educational. Whether you are a seasoned Roblox player or new to the platform, Geometry Spot Roblox offers an immersive environment to test and expand your mathematical intuition.

Gameplay and Features of Geometry Spot Roblox

Unique Puzzle Challenges

What sets Geometry Spot Roblox apart is its variety of geometric puzzles that require careful observation and strategy. These range from shape matching, angle measurements, and creating paths using geometric tools.

The challenges gradually increase in difficulty, allowing players to develop their skills step-by-step while keeping the gameplay fresh and engaging.

Interactive Environment

The game world in Geometry Spot Roblox is designed with vibrant colors and clean, geometric visuals. Every level feels like stepping into a 3D math workbook, where abstract shapes come alive and interact with the player.

The environment encourages exploration, with hidden secrets and bonus puzzles scattered throughout different spots.

Multiplayer and Social Interaction

Roblox is known for its social features, and Geometry Spot Roblox takes advantage of this by allowing players to collaborate on certain puzzles or compete for high scores on leaderboards. This adds a competitive yet friendly dynamic, motivating players to improve their geometry skills.

Why Geometry Spot Roblox Is Great for Learning and Fun

Many parents and educators look for games that combine entertainment with educational value. Geometry Spot Roblox fits this niche perfectly.

Develops Spatial Reasoning

Playing Geometry Spot Roblox helps players improve spatial reasoning, a critical skill used in everything from architecture to engineering and everyday problem solving.

Enhances Problem-Solving Skills

Each puzzle in the game encourages players to think critically and experiment with different solutions, fostering perseverance and creativity.

Accessible to All Ages

With intuitive controls and adjustable difficulty levels, Geometry Spot Roblox is suitable for kids, teens, and adults alike. It provides a fun way to learn geometry concepts without the pressure of a classroom.

Tips to Excel in Geometry Spot Roblox

For those eager to master Geometry Spot Roblox, here are some tips to improve gameplay:

- Understand Basic Geometry Concepts: Familiarize yourself with shapes, angles, and their properties. This foundational knowledge will make puzzles easier to solve.

- Take Time to Explore: Don’t rush through levels. Exploring every corner might reveal helpful clues or hidden puzzles.

- Use the In-Game Tools Wisely: Geometry Spot Roblox offers tools like protractors or rulers within the game. Learn to use them effectively.

- Collaborate with Friends: Join multiplayer sessions to learn different strategies and solve puzzles faster.

- Practice Regularly: Like any skill, practice makes perfect. Frequent gameplay sharpens intuition and reflexes.

Community and Updates Around Geometry Spot Roblox

The popularity of Geometry Spot Roblox has led to a growing community of players who share tips, create fan art, and discuss strategies on forums and social media. Developers regularly update the game with new puzzles, levels, and features, keeping the experience dynamic and exciting.

Joining community groups dedicated to Geometry Spot Roblox is a great way to connect with fellow players and stay updated on the latest news.

How to Access Geometry Spot Roblox

Accessing Geometry Spot Roblox is straightforward:

- Create or log in to a Roblox account.

- Use the search bar and type “Geometry Spot Roblox.”

- Select the official game from the results.

- Click the “Play” button to enter the geometric world.

Since Roblox is free-to-play, there’s no cost involved, though some in-game purchases might be available to enhance the experience.

Why Geometry Spot Roblox Should Be on Every Roblox Player’s List

The fusion of fun, education, and community makes Geometry Spot Roblox a standout title. It offers a refreshing alternative to typical action or roleplay games by focusing on mental challenges and creativity.

Whether for solo play or group sessions, Geometry Spot Roblox fosters a supportive environment where learning and fun go hand in hand.

Final Thoughts

For those passionate about puzzles, mathematics, or simply looking for a new Roblox adventure, Geometry Spot Roblox offers a captivating journey into the world of shapes and logic. Its balanced gameplay, interactive environment, and strong community support ensure that players will find lasting value and enjoyment.

So jump into Geometry Spot Roblox today, explore the geometric challenges, and join a community that celebrates learning through play.